What is the SAVE plan?

Student loan payments start again in October. Biden mentioned this new plan called the SAVE plan, but how could this SAVE plan benefit us? Can we actually take advantage of the SAVE plan? Well, our biggest enemy is interest and the SAVE plan will help us pay a lot less on interest if we use a simple strategy.

The Biden student loan forgiveness plan was knocked out by the supreme court on the 30th of June 2023. There will be no debt wipe out and Biden had mentioned in his response that they will be working on an alternative.

When will the alternative come? Well… that is the questions everyone is asking. It doesn’t look like it will be anytime soon because they suggested that we start paying off our loans according to the studentaid.gov website.

September 1st marks the restart of interest. If it was only the principal due it wouldn’t be a problem paying it back, but when interest is involved it means potentially paying double the amount already due.

The SAVE plan has 3 main benefits

Lowers monthly payments

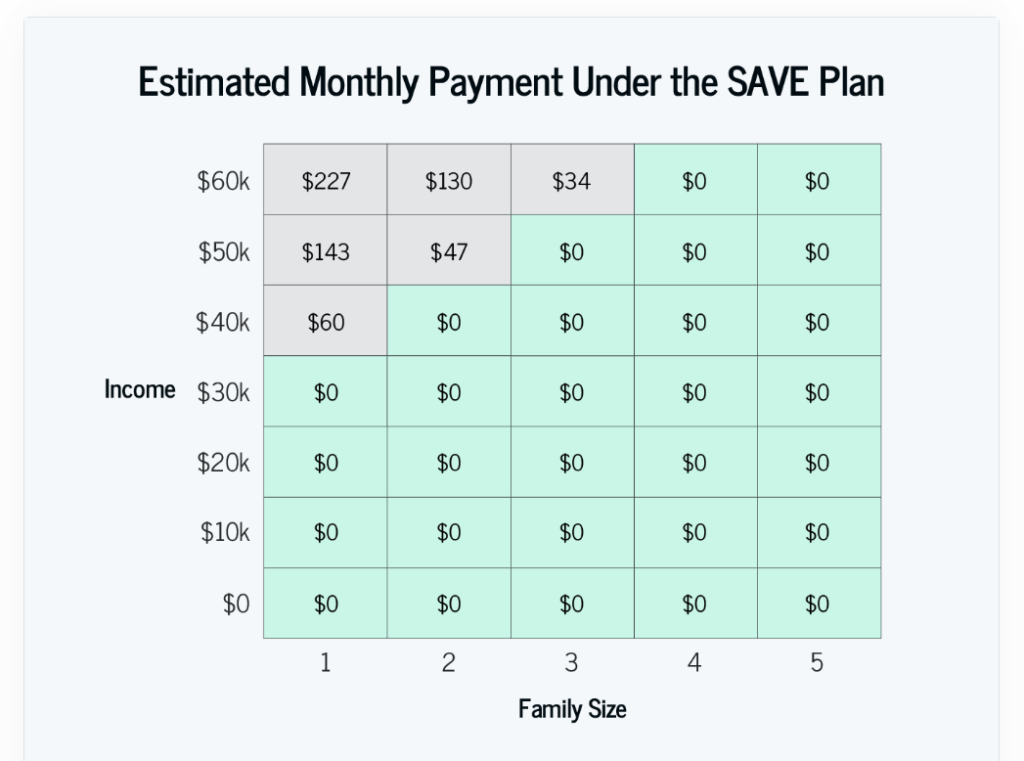

Based on your income it will determine how much you will pay monthly. Below is the chart from the studentaid.gov website that explains just that.

The SAVE plan will not charge you for 100% of interest that exceeds the monthly payment

What does this mean? Let’s say you pay $30 a month, and your monthly interest is $70. You will not be charged the $50 in interest that went over your monthly payment.

Your spouse’s income won’t be included in the income calculations

If you are married and you file separately for the upcoming 2023 taxes. You won’t have your spouse’s income added to your income when they calculate your monthly payment.

I will explain bellow exactly how to take advantage of the SAVE plan, and show you a strategy so you don’t stress over your payments.

How do I apply? Am I qualified for it?

How do you apply for the SAVE plan is an important question since it hasn’t rolled out yet? Basically, you will apply for the REPAYE plan in the income driven repayment section. The REPAYE plan will default into the SAVE plan by the end of 2023.

How do I know I am qualified? There is a chart on the studentaid.gov website and it breaks down the income eligibility. Based on your income you will be able to estimate just how much you might qualify for monthly.

How do I take advantage of the SAVE plan?

Like I mentioned earlier, the enemy we are fighting here is interest. We want to pay as little interest as possible while maintaining an affordable monthly payment.

What the SAVE plan will do is save us time and interest. How? Well… by lowering the monthly payment, it lowers the amount of interest to be charged.

BUT, you must not sleep on these low payments and think it is chill time. If you don’t pay anything extra, you are not getting anywhere. If you keep paying the monthly payment, basically interest, your principle is not decreasing.

For example, you have a $60k loan with a 5% interest rate and your monthly payment is $150. Interest will end up being $250 monthly.

So, if we say you only pay the monthly payment, all you are paying is $150 from the $250 interest that accumulates every month. The other $100 is not charged, but your 60k loan is not getting paid off either.

The strategy is to take advantage of the SAVE plan by using the cut off on interest as a chance to get rid of your debt on your own. This will get you debt free fast and you will be paying a lot less in interest.

Want to read something horrifying? Well…

Did you know if you chose to pay an extra $100 every month over your monthly payment in the previous example, you will end up paying a total of $118k in interest! This doesn’t include the 60k loan.

This will happen over a period of 50 years. Imagine having to pay monthly payment for a lifetime.

Now, if you payed an extra $1k, you will end paying a total of 11k in interest. DO YOU SEE THE DIFFERENCE IN INTEREST? And this will only take 5 years!

Interest is just evil there is just no other way of explaining it.

All in all, the strategy to be able to calculate an extra monthly payment that will save you a ton of interest. I made a whole worksheet that will calculate your total interest based on your extra payment.

Below I have a simple strategy that will lower your stress as you commit to your monthly payments.

Strategy to help take advantage of the SAVE plan

When you are paying extra payments towards your student loans you will need to still sustain your expenses. This two-part simple strategy will allow you to take advantage of the SAVE plan with less stress.

Part one

Get yourself a credit card with a 0% introductory APR for the first 15 to 18 months. This doesn’t mean you have to go out an apply to credit cards like crazy. There is a little trick that will get you the credit card offer to come to your doorstep.

The trick is to search on google for the offer. For example, type the following into the search bar on google:

“Credit card with 0% introductory APR for 18 months with a $200 entry bonus” and search for it a couple times. Within one to two weeks you will get an offer at your doorstep! It always works…

This 0% APR introductory will help you cushion your expenses until you are able to adapt to your monthly payment.

Part two

Evaluate your spending habits and find ways to save. Cutting off on unnecessary spending is crucial to lowering your stress levels.

There are two posts that will get you on track to saving and cutting of on spending. Maintain a shopping budget, and save money on things you never thought of.

Before you go

Biden’s plan failed us, and we are about to resume on student loan payments. There is a new plan called the SAVE plan that will help us fight the war on interest.

There are strategies to take advantage of the SAVE plan. In order to be able to save big on interest and succeed in the student debt repayment journey, you need to be wise and committed.

Next, figure out how to use a credit card wisely and make money

So long…