Is our credit card information at risk?

Over 100k identity theft and personal breaches happen every year. That is a huge number of cases which answers the question. So, what are practical ways to protect your credit card?

I use a credit card for most of my purchases, and my top priority is my credit card protection. If you use a credit card then you definitely want to know about protection. In this article I will share 3 practical ways to keep your credit card safe.

I will share exactly how to accomplish these 3 practical ways to protect your credit card. After knowing these you will not have to worry too much anymore about your credit card security.

***Links on this page may be affiliate links. This means that we get credit for anything that is purchased through the link. It doesn’t affect you at all. As an Amazon Associate, I earn from qualifying purchases***

Use a strong password

Using a strong password is crucial for your credit card protection because it significantly enhances the security of your online accounts, including your credit card accounts.

I will give you a guide on how create a strong password and be confident about it, but first here are a few reasons why passwords are important

Preventing unauthorized access

A strong password acts as a barrier against unauthorized individuals attempting to gain access to your credit card information.

It reduces the risk of someone guessing or easily cracking your password and gaining unauthorized entry to your account.

Protection against brute-force attacks

Cybercriminals may employ automated software that systematically tries numerous combinations of passwords to gain access to accounts.

A strong password with a mix of uppercase and lowercase letters, numbers, and special characters makes it extremely difficult for these automated tools to guess your password within a reasonable timeframe.

Mitigating the impact of data breaches

Data breaches are unfortunately common, and they can expose usernames and passwords associated with your credit card accounts. If you use a weak or reused password, cybercriminals who gain access to these breached credentials may attempt to use them on various websites.

Protection against phishing attempts

Phishing is a fraudulent technique where attackers impersonate legitimate organizations to trick users into revealing their sensitive information, such as credit card details and passwords.

By using a strong and unique password, you reduce the likelihood of falling victim to phishing attempts, as the attackers would not possess your actual password.

Safeguarding against dictionary-based attacks

Weak passwords, such as common words or easily guessable phrases, can be vulnerable to dictionary-based attacks. Attackers use software that systematically tries common words and phrases from dictionaries as potential passwords.

A strong password that does not rely on easily guessable words or patterns offers greater protection against such attacks.

How do you create a strong password?

Here is a little trick to keep in mind when creating any password. I want the password you create to have nothing to do with you. Your name or date of birth would be helpless to a password cracker if you don’t use your info.

Two important characteristics your password should have, length and complexity. At least 12 characters and the longer the better. You should add Upper-letters, lower-letters, special characters, and numbers. All this makes your password complex.

You might ask, well it is easy to make these passwords but how do I remember them? And that is a great question because I have the same problem. I am forgetful lol.

The best way to keep your passwords is to put them in the same place you put your important documents at home.

Wherever you put your passports, social security cards, and all those documents. Jot down your password in a note book or piece of paper and store there.

Let’s say you came up with a great password, how do you know if it is strong or not? I got the exact tool for you.

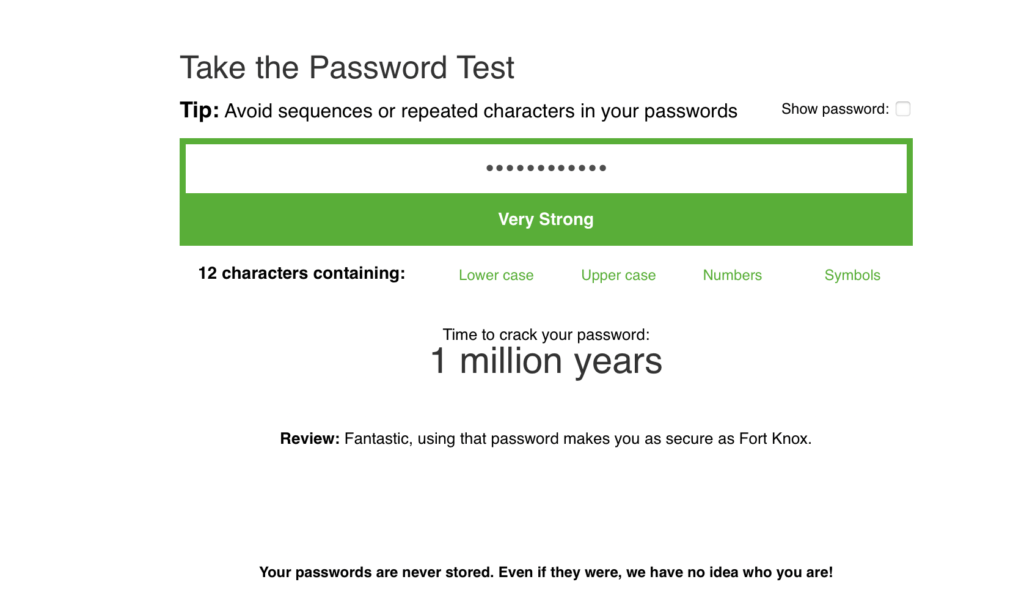

Use this password strength tool to test how strong your password is. The best thing about this tool is that it will also tell you about how long it will take to crack your password.

I made a password and it said it would take around 47 billion years to crack it.

If you are not in the mood to create a complex password and wouldn’t mind someone else doing the hard work, then there are websites out there that will generate a strong password for you. Here is an example – lastpass –

Let’s try it out, I made up this password tesla714#%&X. Now I am going to enter it into the password strength tool. Here is what I got.

Creating a strong password is critical for your credit card protection, but there is one thing to go with your password that will make it even better. Two-factor authentication (2FA).

Whenever possible, enable 2FA for your accounts. 2FA adds an extra layer of security by requiring a second form of verification, such as a temporary code sent to your phone or a fingerprint scan, in addition to your password.

Use a protection layer

Using a protection layer such as a digital wallet is crucial for credit card protection due to several reasons

Enhanced Security

Digital wallets provide an additional layer of security by encrypting and securely storing your credit card information.

When you make a purchase, your actual card details are not shared with the merchant, reducing the risk of your information being intercepted or compromised during transactions.

Tokenization

Digital wallets often use tokenization, a process where your credit card information is replaced with a unique token.

This token is used for transactions instead of sharing your actual card details. Even if a merchant’s system is breached, the tokenized information is useless to attackers, as it cannot be used to make fraudulent transactions.

Reduced Exposure

When you use a digital wallet, you are not required to provide your credit card information directly to each merchant you transact with.

Instead, you can simply authorize the payment using your digital wallet, which adds an extra layer of privacy and reduces the risk of your information being stored or mishandled by multiple merchants.

Authentication Methods

Digital wallets often utilize strong authentication methods such as biometric authentication (fingerprint, face recognition) or device passcodes.

These methods help ensure that only authorized users can access and use your credit card information stored within the digital wallet.

Monitoring and Control

Digital wallets typically offer features that allow you to monitor and control your transactions more effectively.

You can often view detailed transaction history, set spending limits, receive real-time notifications, and easily suspend or disable your digital wallet if your device is lost or stolen.

Compatibility and Convenience

Digital wallets are widely accepted, online and in physical stores.

They offer a convenient way to make secure and quick transactions without the need to carry physical credit cards or manually enter card details for every purchase.

Here is how to set up a digital wallet on your phone

For iPhones

Ensure your iPhone is running on the latest version of iOS. Go to “Settings” > “General” > “Software Update” and check for any available updates.

Open the “Wallet” app on your iPhone. If you can’t find it on your home screen, swipe down and use the search function to locate it.

Tap on the “+” (plus) sign in the upper-right corner of the Wallet app.

You will be prompted to add a card. You can choose to add a credit or debit card, store card, or other supported cards.

If your iPhone has a built-in NFC (Near Field Communication) reader, you can tap “Continue” and position your card within the frame to automatically capture the card details. Alternatively, you can choose to enter the card details manually by tapping on “Enter Card Details Manually.”

Follow the on-screen instructions to enter the required information, including the card number, expiration date, and security code.

Depending on your card issuer, you may be asked to verify your card through a verification process. This can involve receiving a one-time password (OTP) via SMS or email, or using the card issuer’s mobile app to authenticate the card.

Once your card is added and verified, you may be prompted to set a default card for payments. You can choose the card you prefer to be the default or select “None” if you don’t want to set a default.

Optionally, you can add additional cards by tapping the “+” (plus) sign again and repeating the process.

Your digital wallet is now set up on your iPhone. You can access and manage your cards through the Wallet app.

For Androids

Ensure your Android device is running on the latest version of the operating system. Go to “Settings” > “System” > “Advanced” > “System update” and check for any available updates.

Open the Google Play Store on your Android device.

Search for and download a digital wallet app that supports Android devices. Google Pay is a popular choice, but there are other options available as well.

Once the app is downloaded and installed, open it.

Follow the on-screen instructions to set up the digital wallet. This usually involves providing your personal information, such as name and email address, and agreeing to the app’s terms and conditions.

If your device supports NFC (Near Field Communication) and you want to add a payment card, tap on the “Cards” or “Add card” option within the app.

You can choose to add a credit or debit card, loyalty card, or other supported cards. Tap on the appropriate option and follow the instructions to add the card details.

Depending on the card issuer, you may be asked to verify the card through a verification process. This can involve receiving a one-time password (OTP) via SMS or email, or using the card issuer’s mobile app to authenticate the card.

Once your card is added and verified, you may be prompted to set it as the default card for payments. You can choose the card you prefer to be the default or skip this step if you don’t want to set a default card.

Repeat the process to add any additional cards or other supported items to your digital wallet if desired.

Your digital wallet is now set up on your Android device. You can access and manage your cards and make payments through the digital wallet app.

Don’t use public WiFi or save your credit card info on any device

Using public Wi-Fi networks for credit card transactions is generally not recommended due to several security risks

Lack of Encryption

Public Wi-Fi networks, such as those found in cafes, airports, or hotels, often lack proper encryption.

Without encryption, the data transmitted between your device and the network is not protected, making it easier for hackers to intercept and capture your sensitive information, including credit card details.

Man-in-the-Middle Attacks

Public Wi-Fi networks are susceptible to man-in-the-middle attacks. For example, hackers position themselves between your device and the intended destination, intercepting and potentially altering the data being transmitted.

This can enable them to capture your credit card details or inject malicious code into the communication.

Rogue Networks

Cybercriminals may set up rogue Wi-Fi networks that appear to be legitimate public networks but are actually designed to collect users’ personal information.

These networks have names similar to legitimate networks. By using these rogue networks, hackers can capture your credit card information when you make transactions.

Malware and Malicious Apps

Public Wi-Fi networks are also breeding grounds for malware and malicious apps. Attackers can exploit vulnerabilities in the network to distribute malware or create fake apps that mimic legitimate services.

If you inadvertently download or use such malicious software while connected to a public Wi-Fi network, it can compromise the security of your device and potentially capture your credit card information.

There are several reasons why it is generally recommended not to save your credit card information on any device

Increased Risk of Unauthorized Access

Saving your credit card information on a device it increases the risk of unauthorized access to your sensitive data.

Limited Control

Saving your credit card information on a device gives you less control over who can access it.

You may lend your device to someone, sell it, or dispose of it without properly erasing the data. In that case, others can gain access to your credit cards.

Potential for Accidental Use

For example, someone else using your device may inadvertently make a purchase without your knowledge or permission.

Before you go

Now you know the 3 practical ways to protect your credit card. Create a strong password, use a digital wallet, and avoid using your credit card on public WiFi or saving it on any device.

If you are able to maintain these 3 protection tips you won’t have to worry about your credit card safety. Other than that, I would recommend you go ahead and check out my post on the mistakes made when using credit cards.

So long…