Is there a way to write off my student loan payments on my taxes? Probably a popular question when it comes time to file taxes. It seems that there should be something out there for paying off all those loans. So, how does student loans impact your taxes?

As for writing off your loan payments is concerned, no, there is no such thing. BUT there are 3 other ways in which student loans impact your taxes. In this post I am going to go through all 3 of these impacts of student loans on your taxes.

student loans impact your taxes in 3 ways

Student loan interest payment deduction

When you pay off your interest that accumulated on your student debt you can get tax credit for it. You don’t get credit for paying your actual loan off, but you do get credit for paying off the interest.

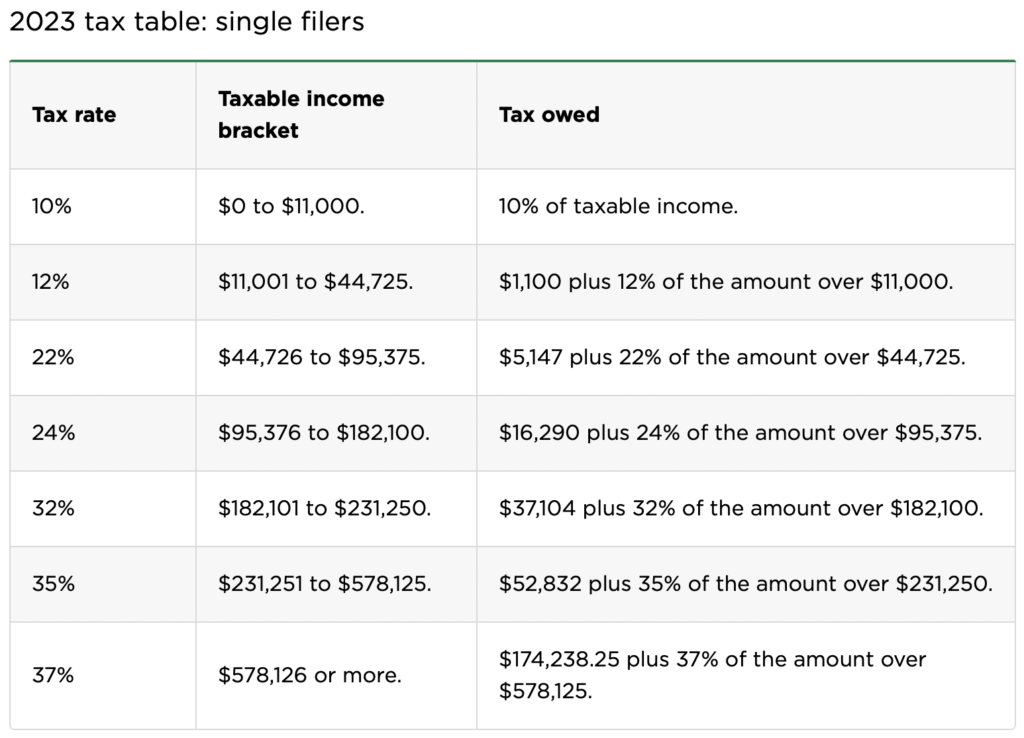

Depending on how much interest was paid off for that year you might get up to 2,500 in deduction on your taxes. If you are in the 22% tax bracket this means you might save up to $550 on your taxes.

How do I qualify? Well…

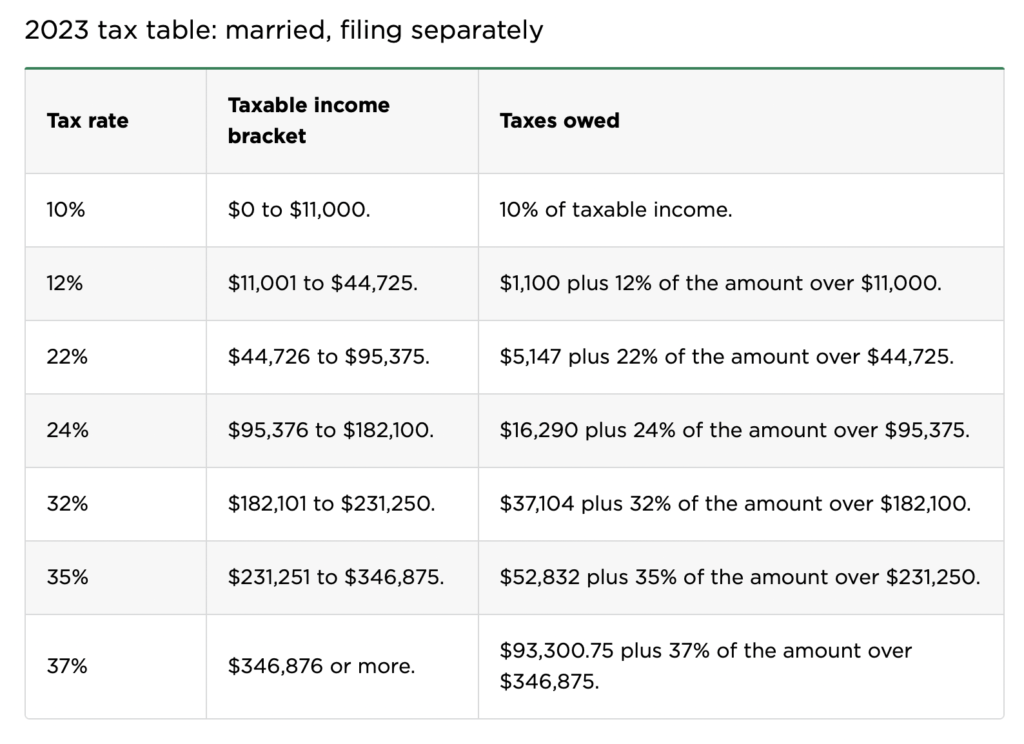

You have to be legally obligated to pay off that loan, and you have to be making less than 85k if you are single. If you are married, you have to make less than 170k to qualify. Also, if you are married and file separately you won’t qualify.

Basically, if you paid more than $600 in interest in that calendar year, you will get a 1098-E form from your student loan servicer. All you have to do is file it with your taxes.

On the other hand, if you paid less than $600 during that calendar year, you need to look up on your student aid account how much interest you made.

The student loan servicer will not provide a 1098-E form for less than $600 payments in interest unless you ask.

Student loan forgiveness tax

If you receive forgiveness for any type of loan you will have to pay taxes on it. So, you payoff your student loan and after 20 years of payments the rest is forgiven. The amount forgiven will be considered taxable income.

Yes, that is correct, if the Biden student loan forgiveness plan were to have went through we would have had to pay taxes on the amount forgiven.

EXCEPT if you are enrolled in the Private Service Loan Forgiveness Plan. This plan qualifies the students that end up working government jobs or non-profits for forgiveness after a certain number of payments made.

Forgiveness under the PSLFP is not considered taxable income so it won’t be taxed.

BUT, If you are enrolled in the new Biden SAVE plan or any other income driven repayment plan, and you get any forgiveness after making a certain number of payment it will be taxed.

Employer aid

Some employers offer formal student loan repayment assistance programs as part of their benefits package.

These programs typically provide a certain amount of financial aid towards an employee’s student loans each year, helping them reduce their debt burden faster.

For example, at a hospital I used work at, if you were a full time employee they would pay a certain amount towards your student debt. However, there would be other terms like having to work for 2 years with the company or something.

Any aid received towards student loans from an employer is considered taxable income. For example, if you got 10k from an employer expect to get charged around 2,200 in taxes if you happen to be I the 22% tax bracket.

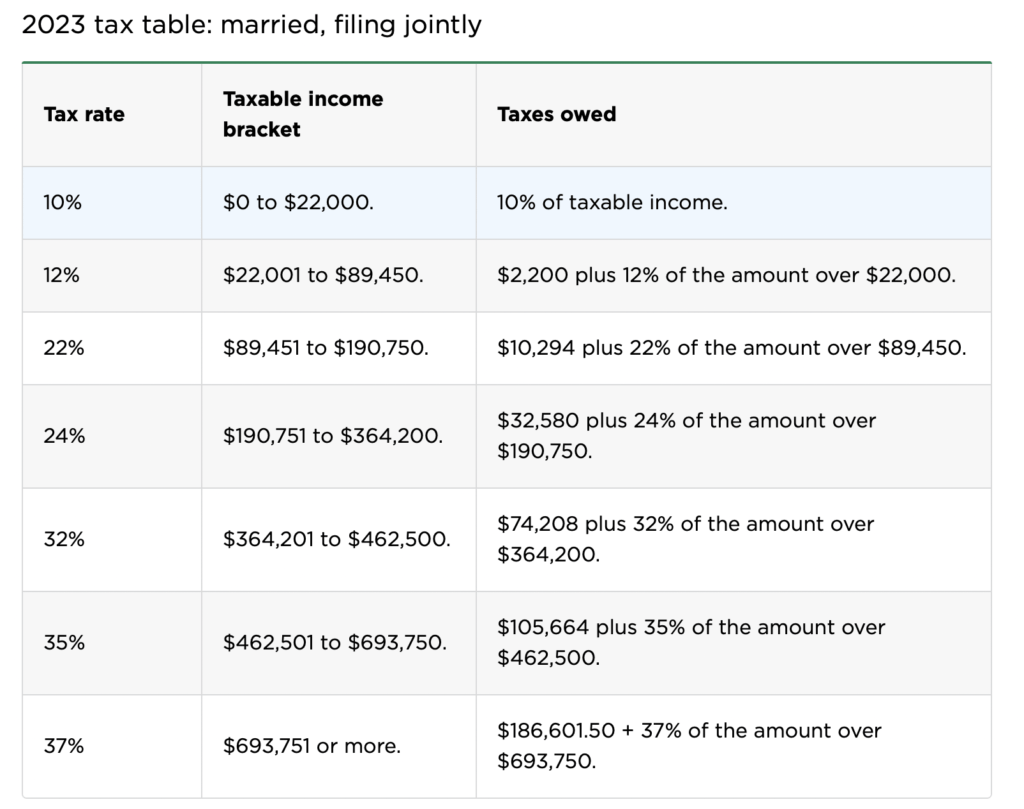

Tax bracket to calculate student loans impact your taxes

If you are single

married filing jointly

married filing separately

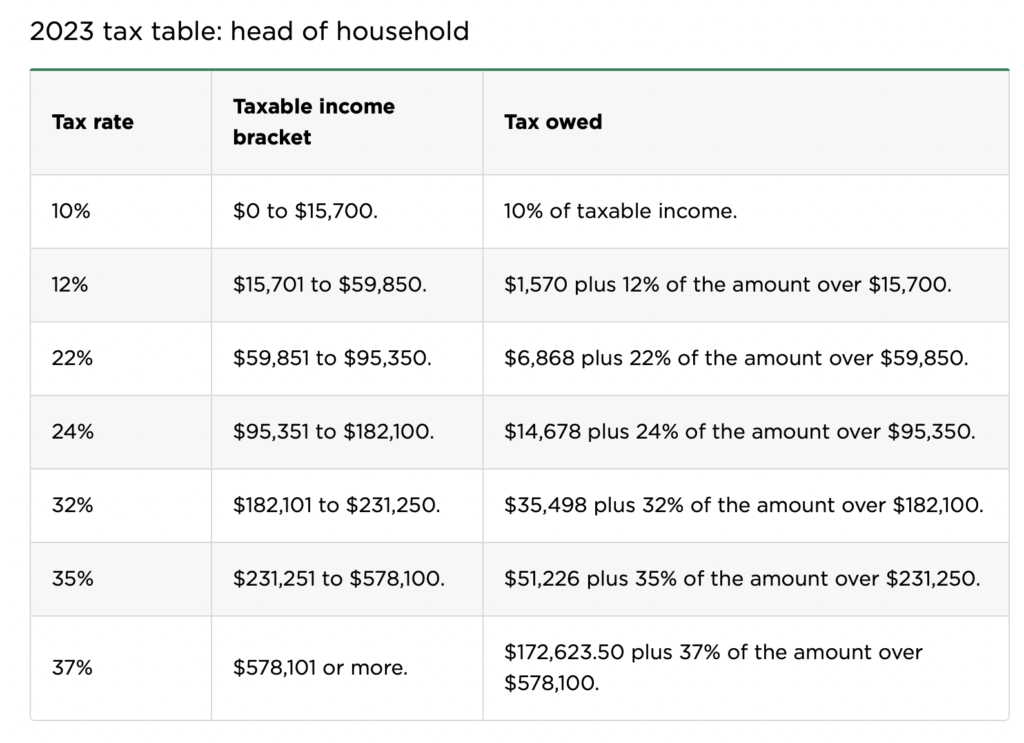

head of the household

before you go

It is important to research what impacts the things you are involved in. Student loans can impact your taxes and you might have to pay extra in some cases. Considering your options and looking at consequences might save you some money in the long run.

Next, head over to my post on how to take advantage of the Biden SAVE plan for student loans.