Biden’s SAVE plan for student loans has many benefits. The two best benefits so far are the low monthly payment and the interest relief. BUT there is another benefit when combined with the previous two benefits will make the top spot in the SAVE plan benefits. This is the benefit of the SAVE plan that will cut off from your total loan.

Yes, even though the Biden student loan forgiveness plan was struck down there is still a chance to get forgiveness. This benefit is the forgiveness of the loan after 20 years of payments were made. In this post I will share the formula where you can calculate exactly how much you can save off your loan.

What is the SAVE plan ?

The SAVE plan is an income driven student payment plan that will replace the REPAYE plan. There are several income driven payment plans and the SAVE plan is suppose to be the best.

The SAVE plan has 3 key features as follows:

Low monthly payments

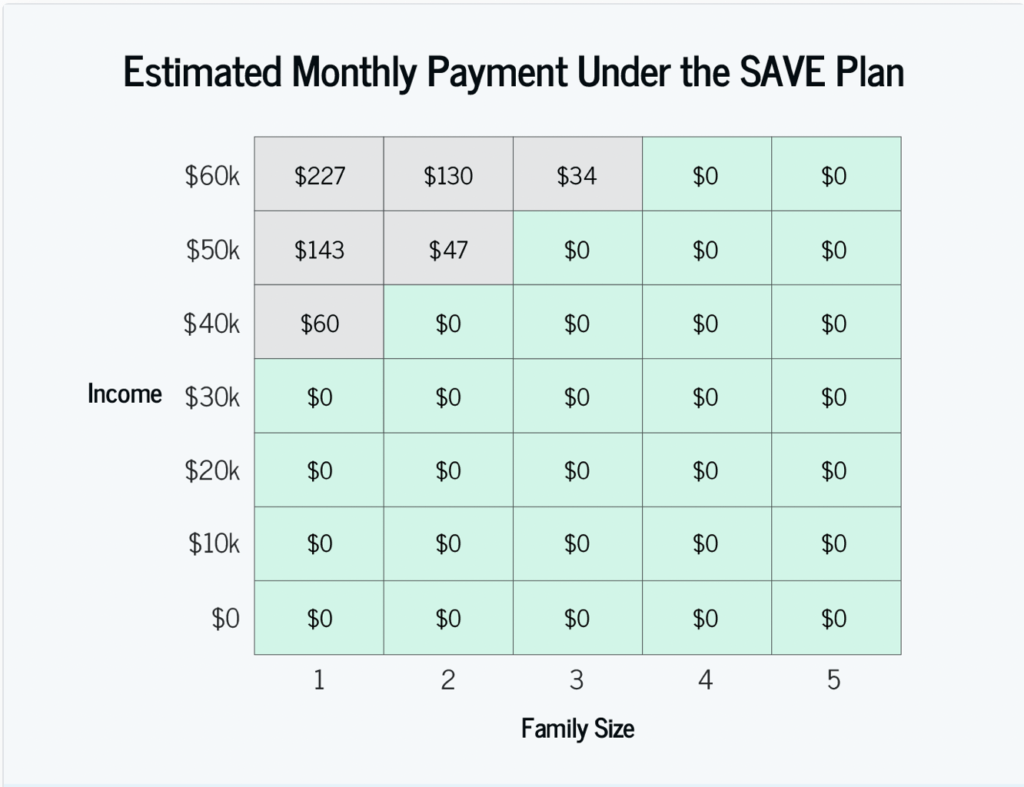

When you are enrolled in the SAVE plan they will evaluate your income and assign you a monthly payment. The monthly payment has a max of $227 so you won’t pay anymore than that.

Interest relief

100% of interest that exceeds the monthly payment will not be charged. For example, if you have a monthly interest fee of $50 and you pay a monthly payment of $30, you won’t be charged the $20.

This means as long as you make the monthly payment on time your balance will not grow in interest.

The benefit of the SAVE plan that will cut off from your total loan

This the benefit that will wipe out a chunk of your student loan. You will be able to back less than the loan amount you took out.

Also, you won’t have to pay interest as well. Bellow I will explain how this works.

With all these features, the SAVE plan is far better than any other income driven plan out there.

How to qualify for the SAVE plan?

To apply to the SAVE plan, go ahead and apply for the REPAYE plan as it will automatically default into the SAVE plan when it rolls out.

The SAVE plan is based on your income so as long as your income falls in the range of incomes they have set you are qualified.

Bellow is a chart from the studentaid.com website where it shows the income as long as an estimate for a monthly income.

What is the benefit of the SAVE plan that will cut off from your total loan ?

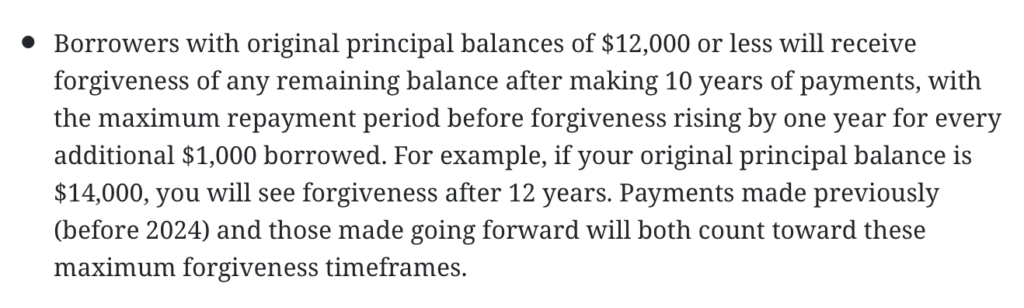

Previously, the income driven plans were following a rule where if a student with an undergraduate loan paid a total of 240 payments the reminder of their debt would be forgiven. The SAVE plan now has a little changes to that as follows:

If your loan is 12k or less

If your loan at the time you started paying it off or originally the loan amount you took out was 12k or less you would get the reminder forgiven in only a total of 120 payments.

Every 1k over 12k will add a year

So, if you have a 14k loan, you will get the remainder forgiven if you pay a total of 168 payments which is equivalent to 12 years of payments.

Anything above 22k

No matter how much your loan is above 22k it will be forgiven once you complete a total of 240 payments.

So how does this help me cut off and save a portion of my loan? Well…

By having low monthly payments the amount you will end up paying off a period of 240 payments will be a lot less than the loan amount you have.

Which means you will get all the rest of your loan forgiven. No interest will be charged either.

There are 5 steps that you walk through to figure out how much you would save

Step one

How much loan do you have? And what is your monthly payment?

Step two

Is it 12k or less? or is it between 12k and 22k? Is It 22k or more?

Step three

Figure out how many years it will take to get forgiveness and multiply it by 12 to get the amount of payments.

Step four

Multiply your monthly payment by the amount of payments

Step five

If this benefit is for you the result of step five will be less than your loan amount.

Let’s look at an example to clear it up…

An example of the benefit of the SAVE plan that will cut off from your total loan

Let’s say Jerry has a 60k loan and I am going to say his income is about 60k as well. This means his monthly payment will be roughly $227.

We have the information for step one. His loan amount is 60k so it is decently more than 22k so his forgiveness will happen after 20 years.

Step three will be 20 * 12 = 240 payments. So, for Jerry to get forgiveness he would have to pay a total of 240 payments.

If we take 240 and multiply it by his monthly payment we will get the total amount he will pay before forgiveness. 240 * 227 = $54,480.

In comparison to the loan Jerry had, 54,480 is 5,520 less than 60k which means Jerry would only pay a total of 54,480. No interest no nothing and the rest will be forgiven.

Before you go

The benefit of the SAVE plan that will cut off from your total loan is defiantly something to look into. BUT if you find yourself not able to save with it check out my other post on how to save big in another way.

So long…